UK lenders prioritise affordability checks as struggling Brits turn to borrowing to make ends meet

LONDON, 25 OCTOBER 2023: Higher loan rejections and limited traditional affordability checks are impacting Brits’ ability to access credit to help make ends meet, according to new research from Tink, the market leader in open banking.

Findings from a survey of 1,000 UK borrowers - those who hold either a mortgage or loan - suggest that a significant number of Brits today need to find a way to bridge the gap between income and expenditure each month.

With nearly one in three (29%) respondents running out of money before the end of each month, many are using credit (25%), instalment or delayed payment options (23%), and loans (16%) to cover essential costs.

Lenders seeing defaults rise as consumers struggle with cost of living

However, Tink’s accompanying survey of 200 UK lenders, including mainstream banks, shows a continued squeeze on consumers’ finances. While many people are turning to credit to make ends meet, more people are finding it difficult to qualify for loans, with 58% of lenders surveyed noting a greater number of rejected applications due to people not meeting the affordability criteria.

This means that some struggling consumers, who may desperately need access to loans, are going to greater lengths to try to secure borrowing.

- More than one in ten (12%) say that when refused a loan, they have reapplied with a different lender.

- An estimated one in ten (9%) borrowers say they have exaggerated their income in their application.

- 9% say they have underreported their monthly outgoings when applying for finance.

- 8% have sought a loan from an unregulated lender because they couldn't secure a loan elsewhere.

- 35% of lenders have seen a rise in application documents being edited.

Tasha Chouhan, UK Head of Banking and Lending at Tink, said: “With many traditional credit checks making it difficult for people to gain access to loans, those who most need financial support are resorting to desperate measures. By prioritising investments in data-driven lending models, lenders can make more informed credit decisions to widen credit access to those who can afford it, while protecting struggling borrowers from getting into financial distress."

Lenders prioritising robust affordability checks

Perhaps as a result, an estimated 82% of lenders believe the cost-of-living crisis makes affordability checks more important than ever and 77% acknowledge the need to improve their risk decisioning models to give the most accurate view of people's finances.

Data-driven tools key to helping lenders manage affordability and fraud issues

Data-driven risk assessment models give financial services providers, with consumer consent, the ability to view transaction data in peoples’ bank accounts. This enables a holistic approach to gathering insights on income and spending behaviours to inform creditworthiness and affordability – increasing financial inclusion and access, while removing unfair barriers to lending encountered by certain consumer cohorts such as those who have irregular income from multiple sources.

Traditional credit checks combined with onerous, often paper-based processes to provide evidence of expenditure and income levels can be time consuming, out of date and end in higher abandonment or rejection rates.

Encouragingly, the vast majority of lenders (84%) surveyed recognise that data-driven risk assessments are key to ensuring they can accurately assess a borrower's ability to afford repayments.

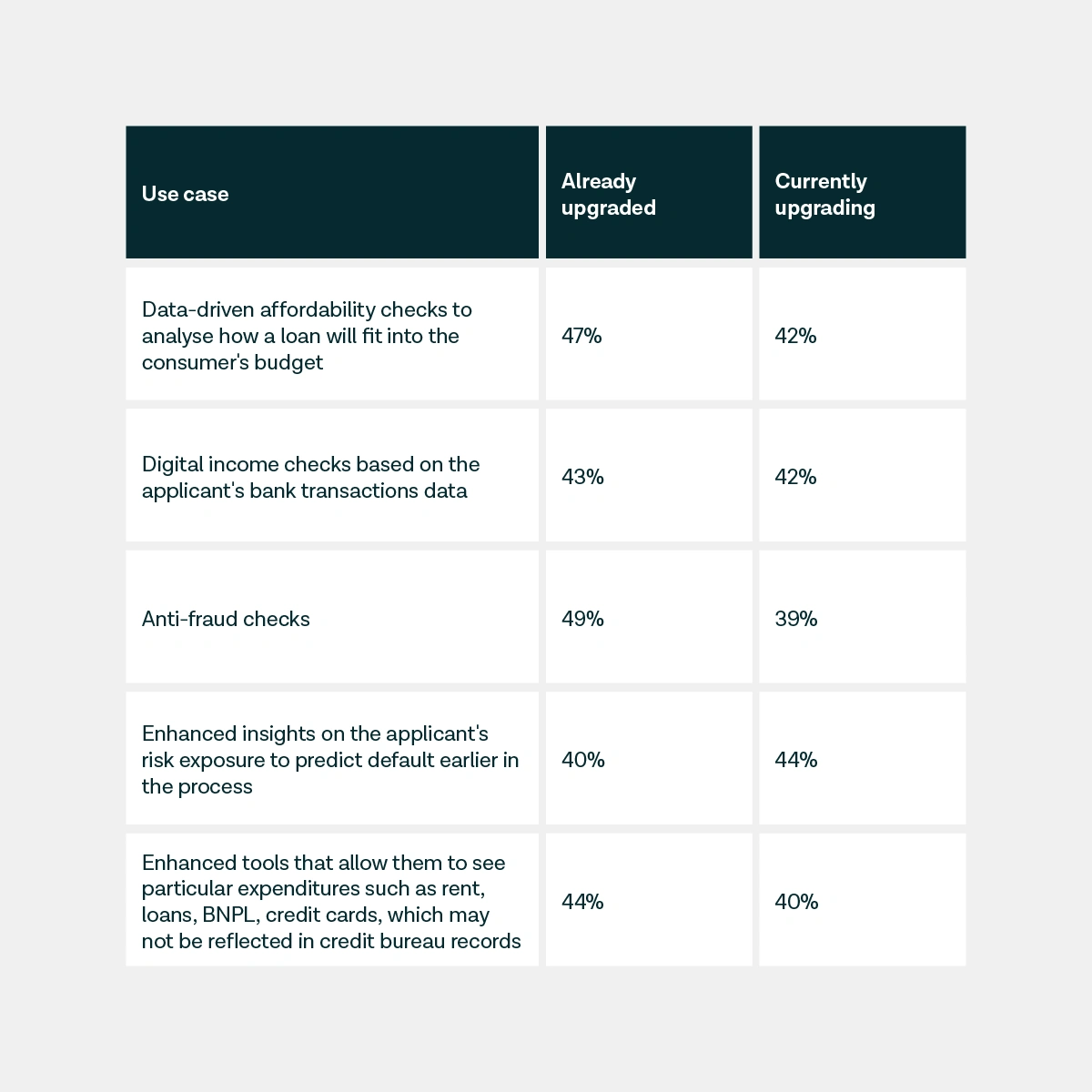

And many lenders are already investing in new data-driven digital tools to enhance their lending models. For example:

Fintech partnerships overcome barriers to adoption of data-driven technologies

An estimated two-thirds (68%) of lenders believe that third-party support is essential to improve their lending models.

And as it stands today, an estimated 43% of lenders are already investing more in fintech partnerships to enhance digital affordability checks as part of their credit underwriting process, while 36% are investing more in fintech partnerships to enhance open banking.

Chouhan continued: “With squeezed budgets and limited internal resources, partnering with a trusted fintech offers lenders a reliable and cost-effective way to make important upgrades to their processes. By embracing data-driven technologies, lenders can ensure they are protecting themselves and their customers today, while future-proofing their models. And we’re seeing this happening now all across Europe. We’ve already helped lenders make better and faster decisions on more than 7 million consumer loan applications in the last year, and we expect to see this double in the next six months.”

– ENDS –

Notes to editor:

Consumer research was conducted by Censuswide on behalf of Tink in September 2023, amongst 1,000 UK borrowers aged over 18 (i.e. those who currently have either a mortgage or a loan).

Lender research was conducted by Censuswide on behalf of Tink in September 2023 amongst 200 executives at a High street bank, Building society, Challenger bank, Payday lender or BNPL lender who have a decision-making role in the lending process.

About Tink:

Tink is the market leader in open banking, enabling banks, fintechs and merchants to build data-driven financial services. Whether that’s making account-to-account payments, onboarding new customers, making better credit decisions or creating money management tools. A wholly owned subsidiary of Visa, Tink has over 6,000 connections to banks with the ability to reach hundreds of millions of people across 18 markets. Since its creation in 2012, Tink has powered the pioneers of open banking and now serves some of the world’s largest financial institutions, taking processes that are filled with friction and replacing them with seamless experiences that eliminate complexity for consumers. We power the new world of finance. For more information visit tink.com.

Contact details:

Linda Winder, PR & Communications Director, press@tink.com, +44 (0)7809 265941

Jemima Wright, Senior Account Manager, Firstlight, jemima.wright@firstlightgroup.io, +44 (0) 7538 456324

---

Case studies, comparisons, statistics, research and recommendations are provided “AS IS” and intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice. Visa Inc. neither makes any warranty or representation as to the completeness or accuracy of the information within this document, nor assumes any liability or responsibility that may result from reliance on such information. The Information contained herein is not intended as investment or legal advice, and readers are encouraged to seek the advice of a competent professional where such advice is required.