Banking on

engagement

A Tink white paper - Attracting and retaining consumers in the fintech era.

The Banker says...

Think to the future

Over two thirds (67%) surveyed banking executives said that attracting young consumers is a vital part of future proofing their business.

Get innovative

There was a recognition that banks need to up their game to win over younger consumers, with 63% acknowledging that younger generations expect more and new innovative products and services from their bank.

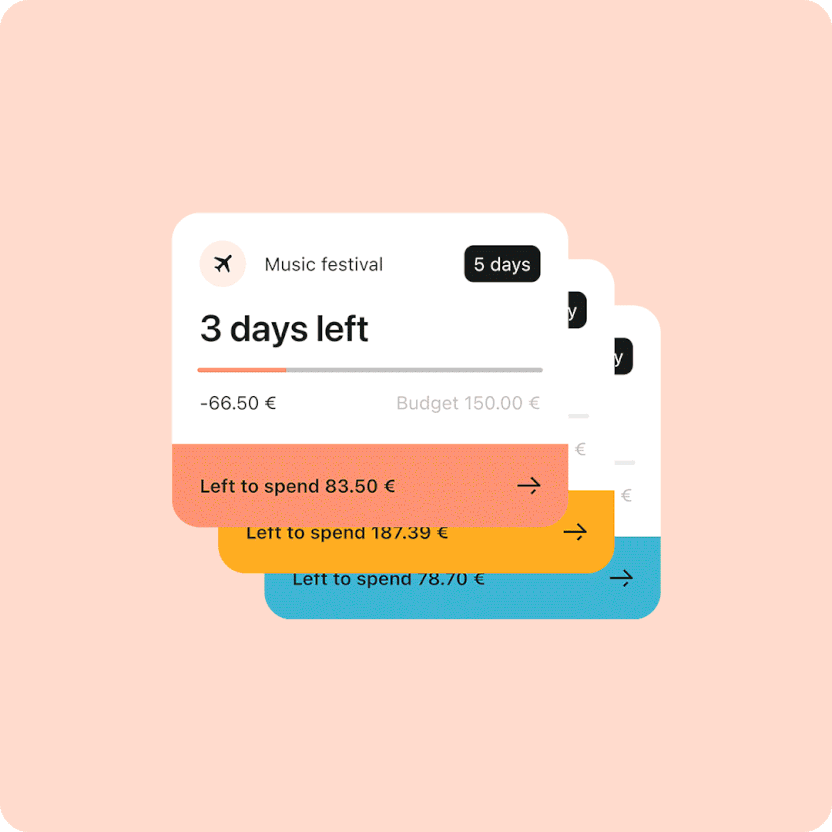

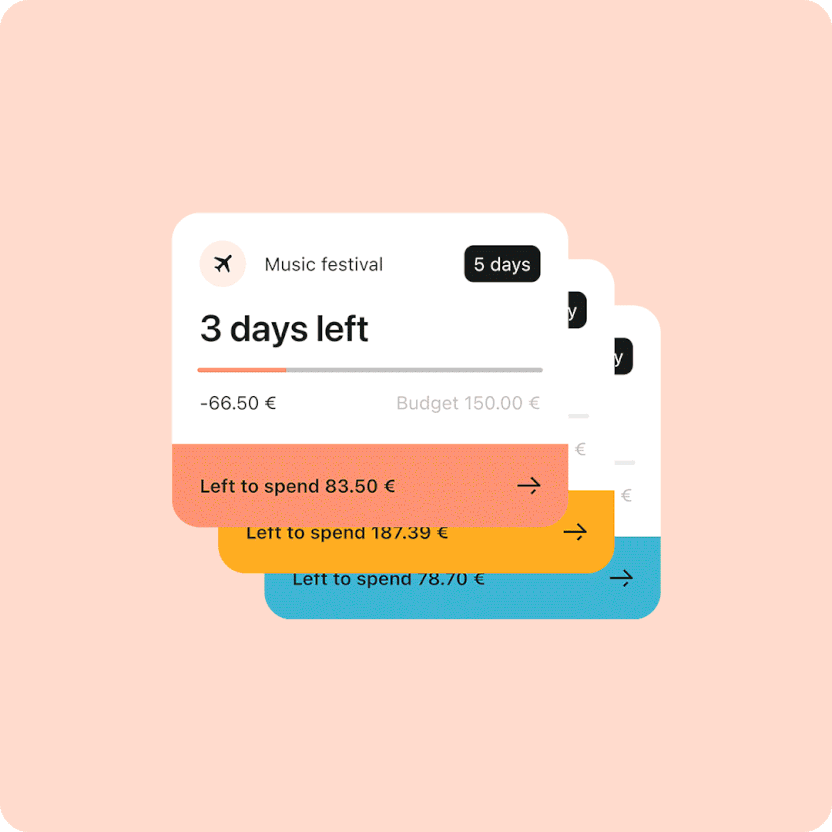

Almost 8 in 10 execs believe in money management tools

Over three quarters (79%) of banking execs surveyed have found new features on their banking app or online banking, like money management tools, are effective as a customer acquisition tool.

Download now

Almost 8 in 10 execs believe in money management tools

Over three quarters (79%) of banking execs surveyed have found new features on their banking app or online banking, like money management tools, are effective as a customer acquisition tool.

Download now74% said PFM tools are great for retention

almost three quarters of those surveyed said that digital financial management tools are also helpful in retaining customers.

Download now

74% said PFM tools are great for retention

almost three quarters of those surveyed said that digital financial management tools are also helpful in retaining customers.

Download nowQuotes

“More than ever, retail banks need to focus their long-term strategies on keeping customers engaged. Continued strong competition in the retail banking market is offering consumers a myriad of options and providers to choose from.”

Jack Spiers

UK&I Banking & Lending Director at Tink

“As consumers gain more insights into their finances, they are more likely to engage with the bank's services, improving their relationship with the bank.”

Olivera Babic

Product Manager at Tink

“We must remember that PFM has advanced from being more of a novelty to a necessity. Consumers want concise, reliable information with minimal effort that goes further than presenting transactional data in a more visual way.”

Cendré Pfannenstill

Senior Product Manager at Tink