Bank Norwegian: automated and simplified

When one of Norway’s leading banks decided to expand into Europe, they needed a way to provide seamless and secure customer journeys across all of their key markets. That's when their path intersected with Tink's.

Find out how they automated their income verification process for loan and credit card applications while also simplifying bill payments for customers.

Bank Norwegian: automated and simplified

When one of Norway’s leading banks decided to expand into Europe, they needed a way to provide seamless and secure customer journeys across all of their key markets. That's when their path intersected with Tink's.

Find out how they automated their income verification process for loan and credit card applications while also simplifying bill payments for customers.

Bank Norwegian's achievements

Verify applicants’ income and ensure correct payslip information seamlessly.

Make better decisions by obtaining accurate data.

Deliver fully digital customer experience.

For industry leaders

“Responsible lending is all about granting the correct credit to the private individual that has the means to service the loan without compromising on other expenses. Tools such as those Tink provides for Bank Norwegian is an enabler of data that supports our philosophy as a provider of a pure digital customer journey.”

Peer Timo Andersen-Ulven

CRO at Bank Norwegian

“Bank Norwegian’s digital DNA is a great match with Tink’s powerful solutions. Bank Norwegian continuously evaluates new use cases where open banking data can empower smooth and reliable customer journeys. So far, this partnership has enabled simpler, faster, and better income verification and invoice payment solutions across multiple markets. I look forward to continuing this exploratory journey together with Bank Norwegian.”

Malin Tjäder

Senior Account Manager at Tink

Build seamless, secure customer journeys

As Bank Norwegian expanded to Sweden, Denmark, Finland and lastly Spain and Germany, they wanted to provide faster, simpler user journeys to their customers. They noticed that loan applications were one of the highest points of friction, followed by invoice payments.

Applying for a loan involved submitting paperwork manually, increasing the time and effort required to gain access to credit. And when it came to loan repayments, customers had to manually enter their bank details while switching between different websites - a time-consuming and error-prone process.

Build seamless, secure customer journeys

As Bank Norwegian expanded to Sweden, Denmark, Finland and lastly Spain and Germany, they wanted to provide faster, simpler user journeys to their customers. They noticed that loan applications were one of the highest points of friction, followed by invoice payments.

Applying for a loan involved submitting paperwork manually, increasing the time and effort required to gain access to credit. And when it came to loan repayments, customers had to manually enter their bank details while switching between different websites - a time-consuming and error-prone process.

Automatic income verification and simpler bill payments

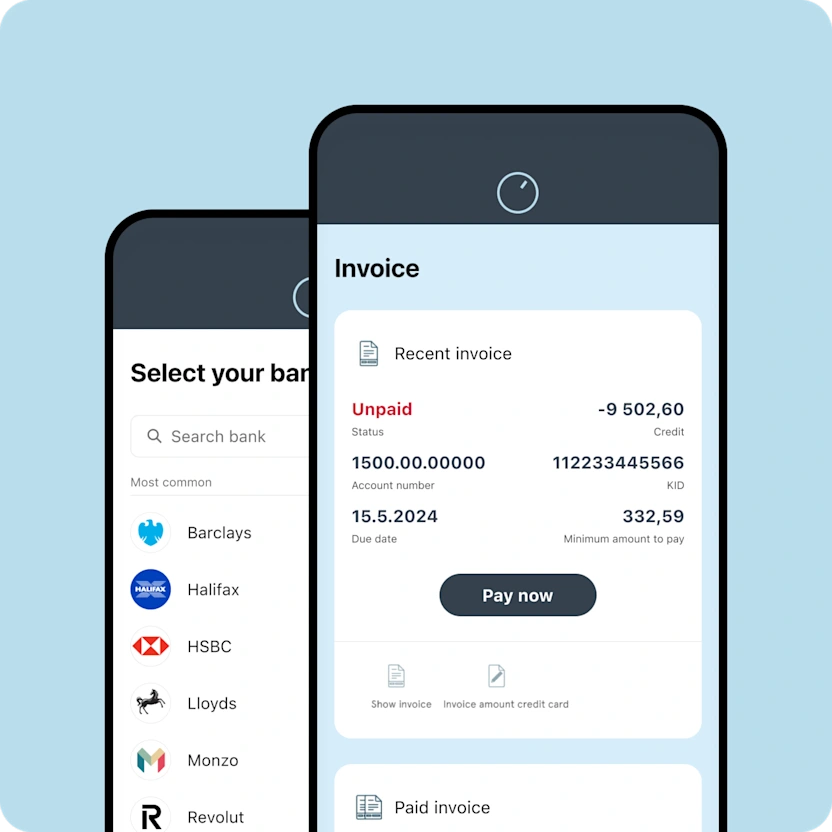

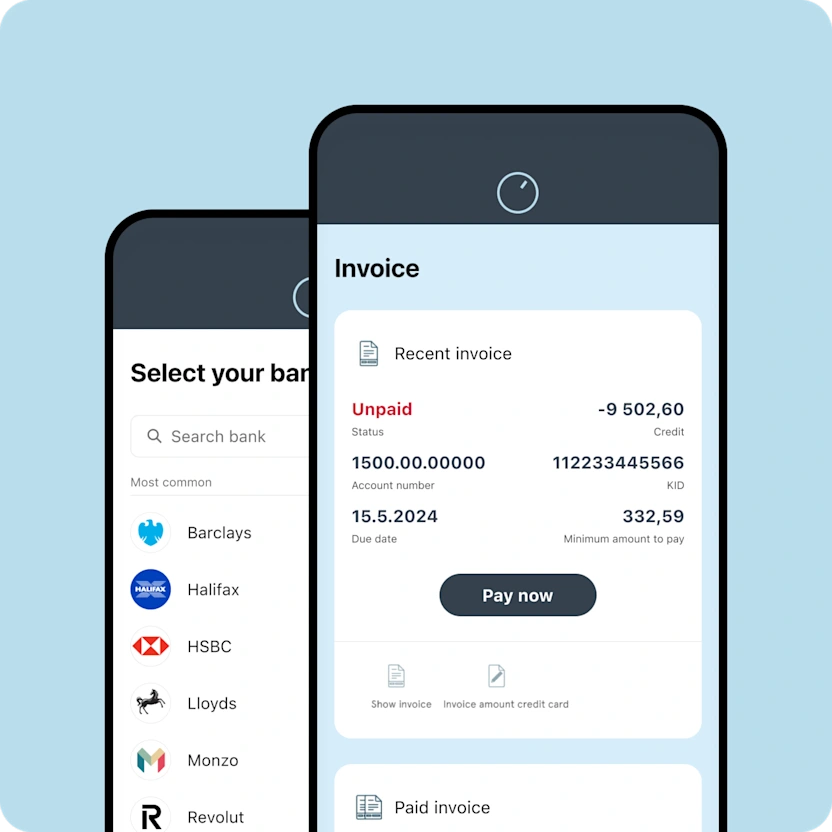

When you are open 24/7 like banknorwegian.se, you need to give access to services in real-time and in a user-friendly way. Tink’s Income Check lets applicants validate their earnings instantly and securely. Once the applicants choose the loan specifications to apply for, they simply click to verify, choose their bank account, and authenticate.

Bank Norwegian also needed a friction-free way to enable invoice payments. They opted for Tink’s pay-by-bank option, which lets users schedule a payment for a specific due date without having to leave the Bank Norwegian interface. This way, Bank Norwegian could replace their direct debit flow with a smooth, cost-effective experience.

Automatic income verification and simpler bill payments

When you are open 24/7 like banknorwegian.se, you need to give access to services in real-time and in a user-friendly way. Tink’s Income Check lets applicants validate their earnings instantly and securely. Once the applicants choose the loan specifications to apply for, they simply click to verify, choose their bank account, and authenticate.

Bank Norwegian also needed a friction-free way to enable invoice payments. They opted for Tink’s pay-by-bank option, which lets users schedule a payment for a specific due date without having to leave the Bank Norwegian interface. This way, Bank Norwegian could replace their direct debit flow with a smooth, cost-effective experience.

A fully digital user experience

Bank Norwegian is a fully digital service. This means that when customers apply for a loan or credit card, or want to open a savings account, they can do so without filling in any papers or sending documents through the mail. Services like Tink help businesses like Bank Norwegian achieve this and supports our philosophy as a purely digital service provider with growth ambitions.

A fully digital user experience

Bank Norwegian is a fully digital service. This means that when customers apply for a loan or credit card, or want to open a savings account, they can do so without filling in any papers or sending documents through the mail. Services like Tink help businesses like Bank Norwegian achieve this and supports our philosophy as a purely digital service provider with growth ambitions.

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.