Get verified financial insight

Create a seamless way of determining a customer's risk exposure at the time of application. Gain a more nuanced understanding of your customers' financials while offering them faster time to money.

Some industries we serve:

Retail banks & consumer finance

Challenger banks & online lenders

BNPL & embedded finance

Utility, water & telco firms

Approve more while taking less risk

A proven set of risk features that have been engineered based on real customer default data thus carry proven predictive power that can be added to your credit scoring models.

Learn more about Risk Insights

Approve more while taking less risk

A proven set of risk features that have been engineered based on real customer default data thus carry proven predictive power that can be added to your credit scoring models.

Learn more about Risk Insights

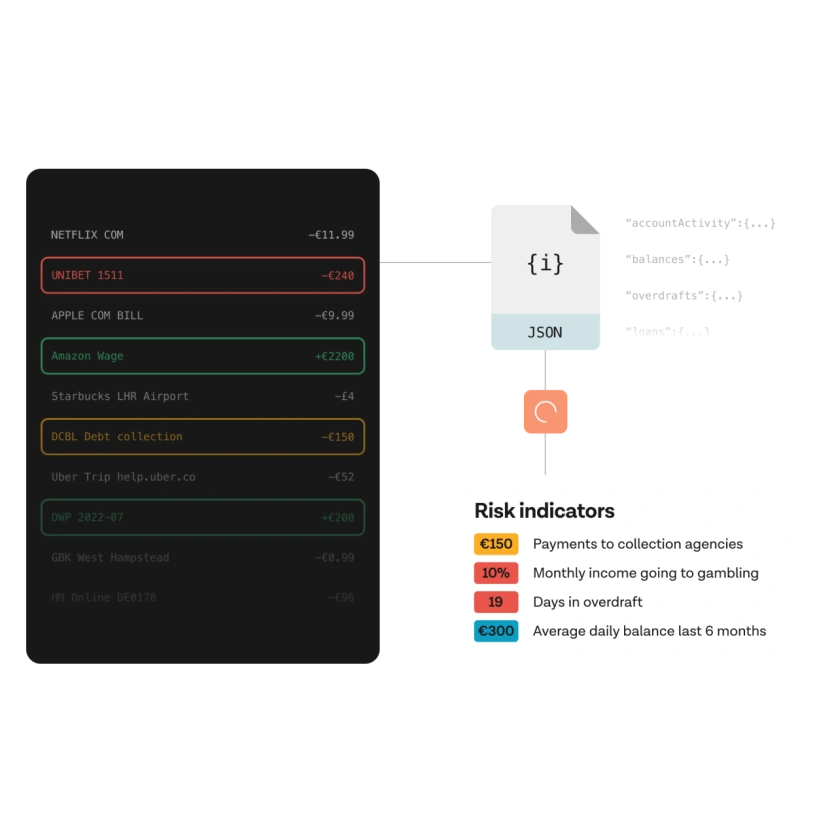

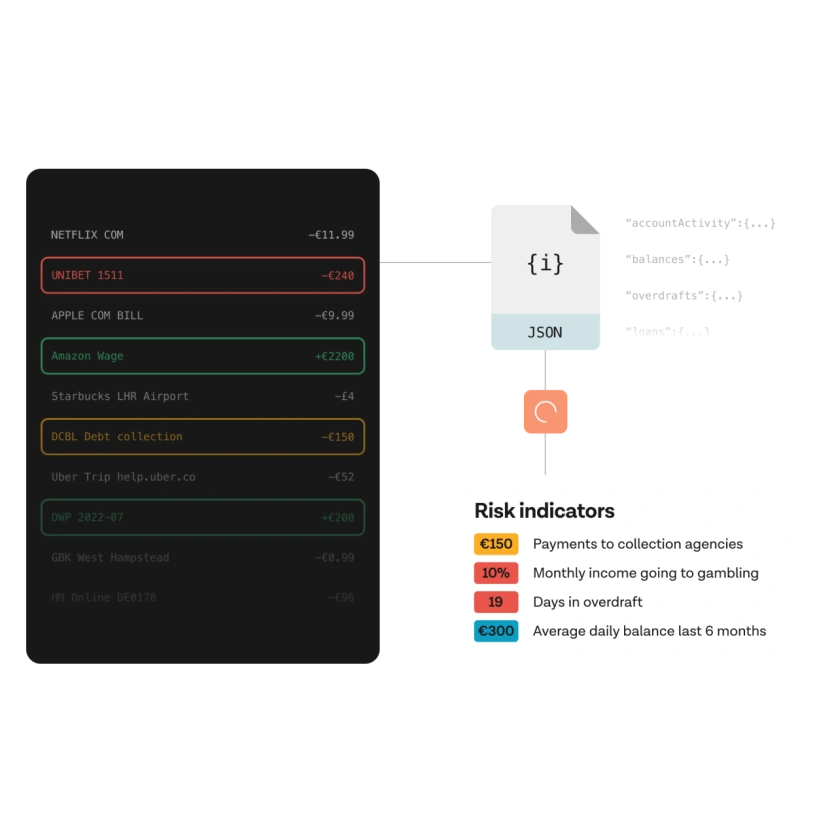

A deeper dive into the applicant’s spending habits

Broaden your understanding of the applicant’s creditworthiness with historical insights reflecting monetary habits such as gambling, spending, ATM behaviour and over 300 other features.

Learn more about Risk Insights

A deeper dive into the applicant’s spending habits

Broaden your understanding of the applicant’s creditworthiness with historical insights reflecting monetary habits such as gambling, spending, ATM behaviour and over 300 other features.

Learn more about Risk InsightsOnboard your clients within minutes (instead of days).

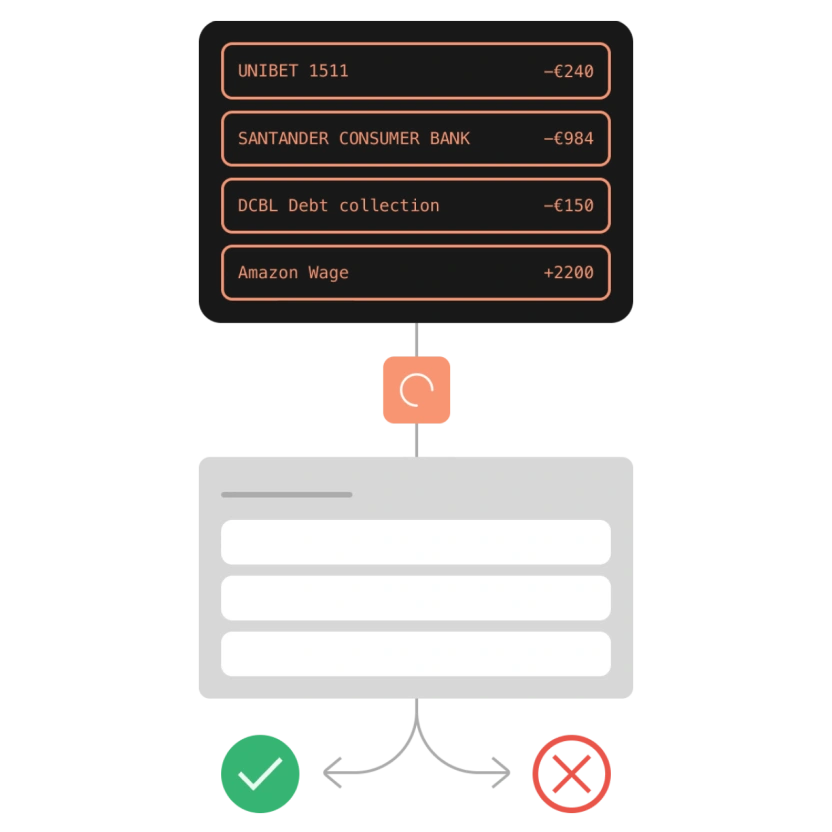

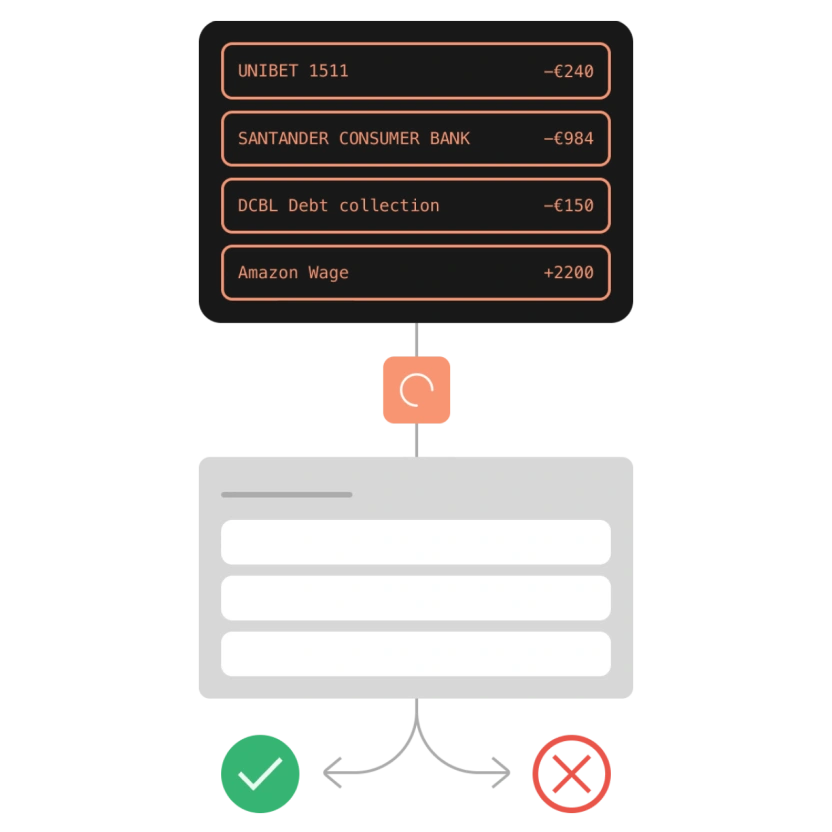

Offer a seamless application process with pre-filled fields and verified transaction data. Reduce friction and drop-offs due to manual input and paperwork from applicants.

Onboard your clients within minutes (instead of days).

Offer a seamless application process with pre-filled fields and verified transaction data. Reduce friction and drop-offs due to manual input and paperwork from applicants.

GF Money uses Tink to provide shorter time-to-money

Challenge

Relying on credit bureaus for risk assessments or affordability checks takes time, comes at a cost, and provides a limited and sometimes out-of-date picture of creditworthiness.

Solution

Powered by open banking, loan applicants can connect their bank account to instantly provide a complete and verified assessment of their current income level.

Income Check

GF Money uses Tink to provide shorter time-to-money

Challenge

Relying on credit bureaus for risk assessments or affordability checks takes time, comes at a cost, and provides a limited and sometimes out-of-date picture of creditworthiness.

Solution

Powered by open banking, loan applicants can connect their bank account to instantly provide a complete and verified assessment of their current income level.

Income Check

For industry leaders

“With Tink we have provided our customers with a much smoother way to prove their income and their creditworthiness, which has helped us reduce our application processing time down to less than 10 mins. It has helped us increase our automated funnel which in turn increased approval rates, faster time to money, and reduced risk of fraud and uncompleted applications - all real difference makers for our growth.”

David Öhlund

CEO at GF Money

Predict repayment capacity better with real-time data

Use real-time data to review income, expenses and spending patterns predicting repayment capacity.

Better decisions

Improving models of the probability of default has resulted in multiple Gini uplifts for our customers.

Decrease fraud

Our customers decreased cases of fraud significantly by replacing manual input with verified data from the applicant's bank account.

Improve your risk models

Use a granular set of features with proven predictive power derived from default data to improve your credit risk modelling.

Improve your underwriting workflow with open banking

Credit decisioning with real-time financial data is faster and more convenient than traditional loan origination processes. Simplify and streamline applications while improving your underwriting workflows.

53%

Assess earnings correctly - 53% of UK lenders said in our latest survey that documents showing proof of income were most important when making decisions. Accurate assessments are much easiert to achieve with Tink.

41%

Understand spending habits - according to top UK lenders, high friction in the application process often arises from monthly expense evaluations, with 41% of respondents saying that this was where they saw the highest applicant drop-off.

40%

Increase adoption - our customer reported that the adoption rate increased from 10% to 40% with no instances of fraud when Tink was used.

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.