Streamline deposits with instant payments

Build frictionless payment experiences with instant account and digital wallet top-ups.

Some industries we serve:

Wealth management

Financial services

iGaming

Crypto & trading

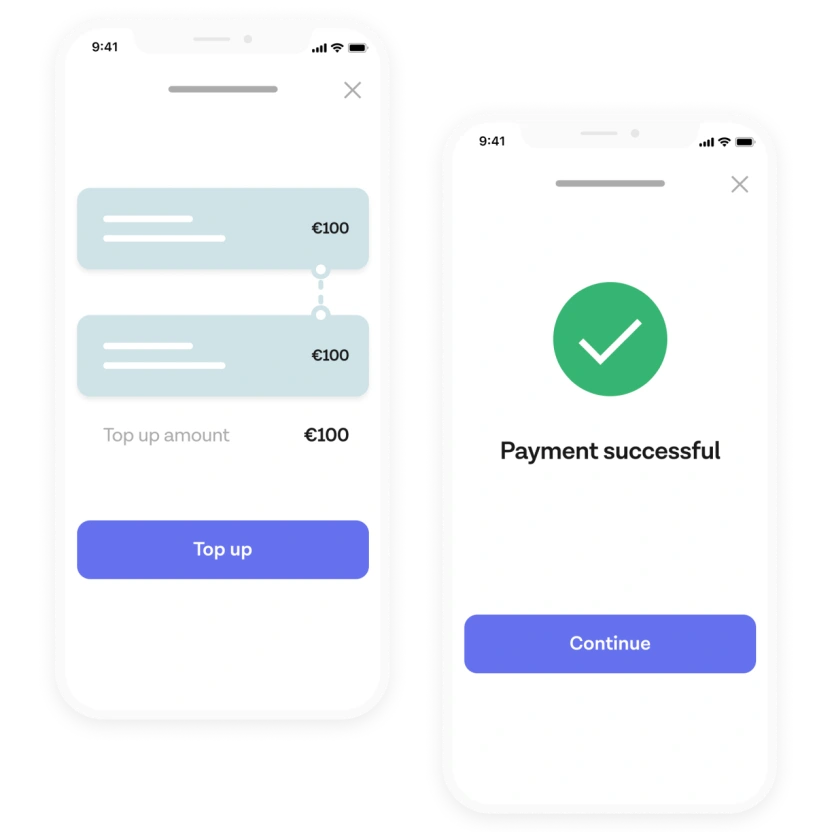

Make pay-ins fast and effortless

Offer instant deposits with real-time payment confirmation and settlement – letting you provide users immediate access to your service. We also support automated reconciliation and batch settlement.

‘Tink lets us add easy, frictionless payments to our instant onboarding experience, enabling anyone to invest in crypto in less than 2 minutes.’ – Jamie McNaught, co-founder and CEO at Solidi

Learn about Payments

Make pay-ins fast and effortless

Offer instant deposits with real-time payment confirmation and settlement – letting you provide users immediate access to your service. We also support automated reconciliation and batch settlement.

‘Tink lets us add easy, frictionless payments to our instant onboarding experience, enabling anyone to invest in crypto in less than 2 minutes.’ – Jamie McNaught, co-founder and CEO at Solidi

Learn about Payments

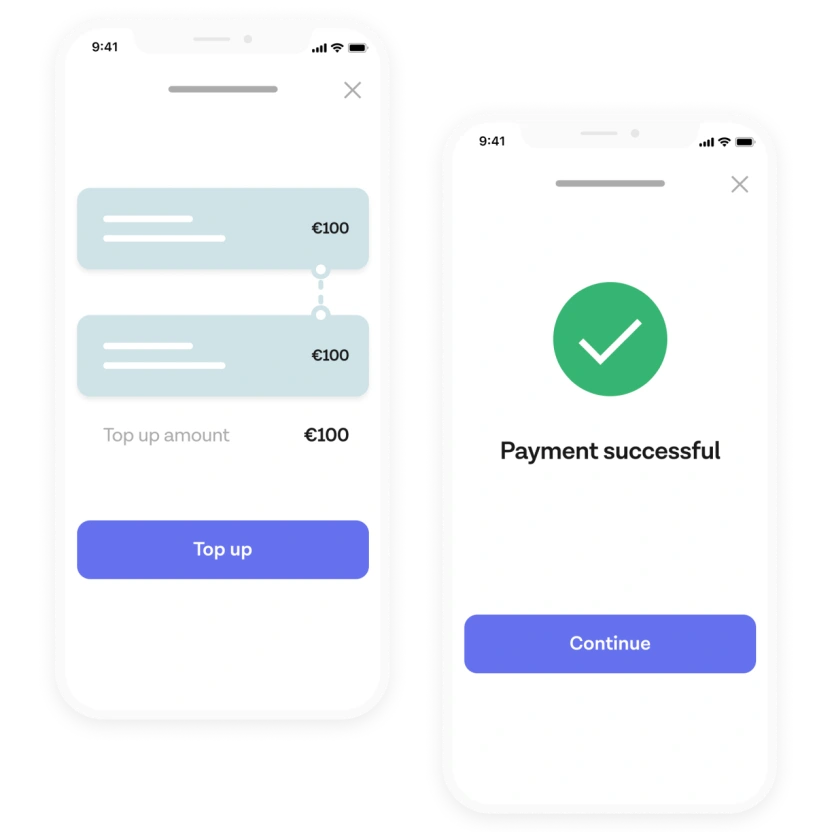

Delight users with real-time withdrawals

Give users the ability to withdraw funds and cash out instantly. You can automate payouts from your Tink-managed settlement account via API, giving users immediate access to their money with no extra work.

Learn about settlement accounts

Delight users with real-time withdrawals

Give users the ability to withdraw funds and cash out instantly. You can automate payouts from your Tink-managed settlement account via API, giving users immediate access to their money with no extra work.

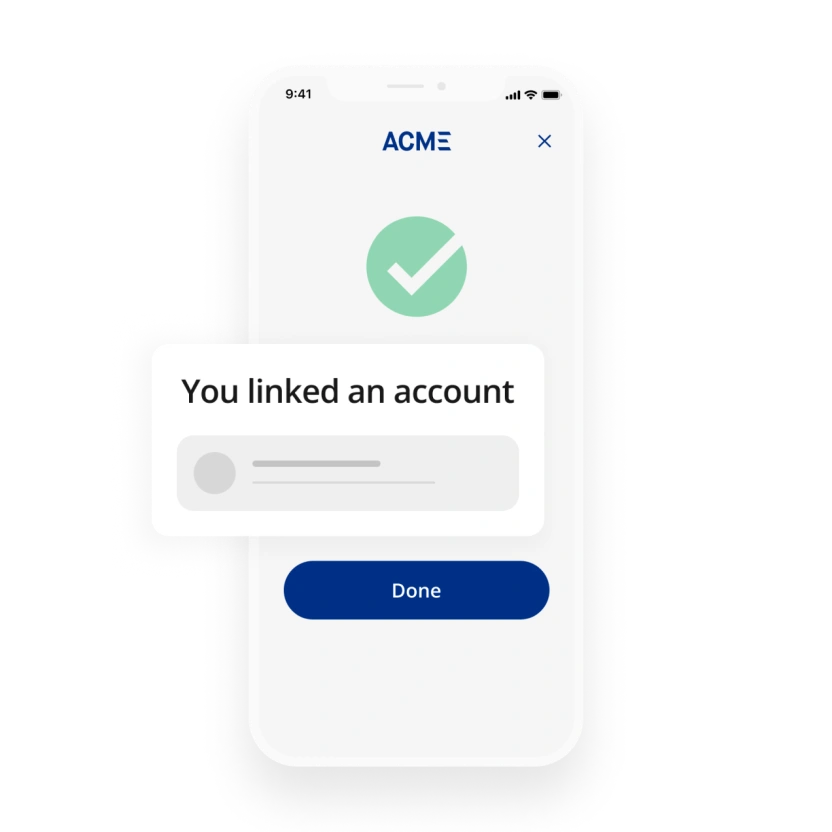

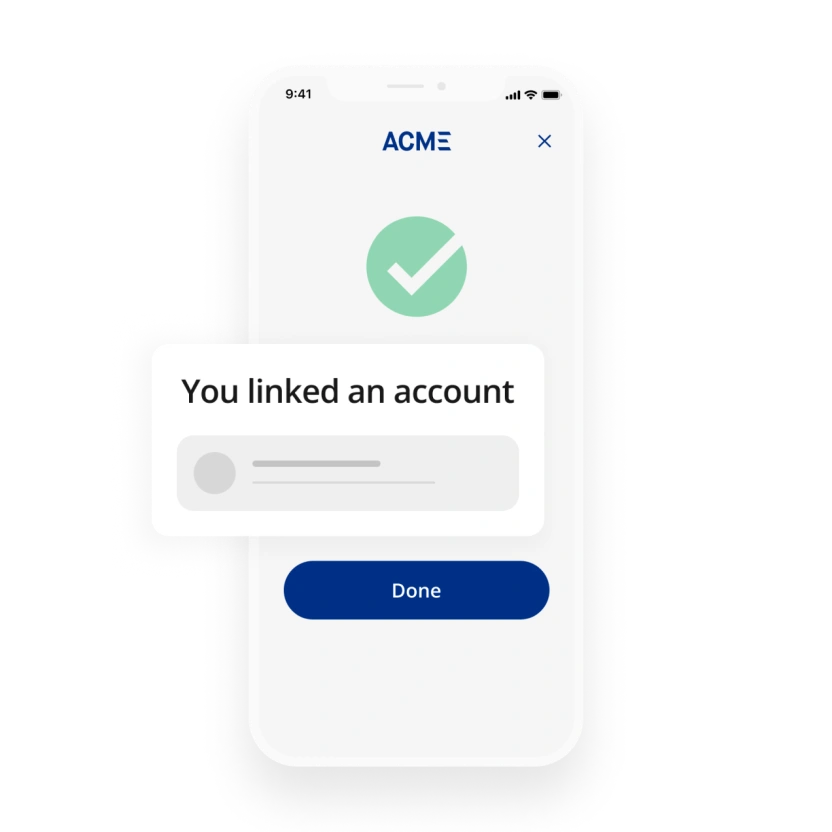

Learn about settlement accountsStreamline payment and onboarding flows

Maximise conversion with fast, mobile-first account and identity verification flows. With Tink you can verify account information in the payments journey itself, enabling real-time checks and minimising the number of steps.

‘The quality of the end-user experience is key for us. Tink was the obvious choice to help make our product experience as simple and as user-friendly as possible.’ – Ylla von Malmborg, Product Manager at Billogram

Learn about customer onboarding

Streamline payment and onboarding flows

Maximise conversion with fast, mobile-first account and identity verification flows. With Tink you can verify account information in the payments journey itself, enabling real-time checks and minimising the number of steps.

‘The quality of the end-user experience is key for us. Tink was the obvious choice to help make our product experience as simple and as user-friendly as possible.’ – Ylla von Malmborg, Product Manager at Billogram

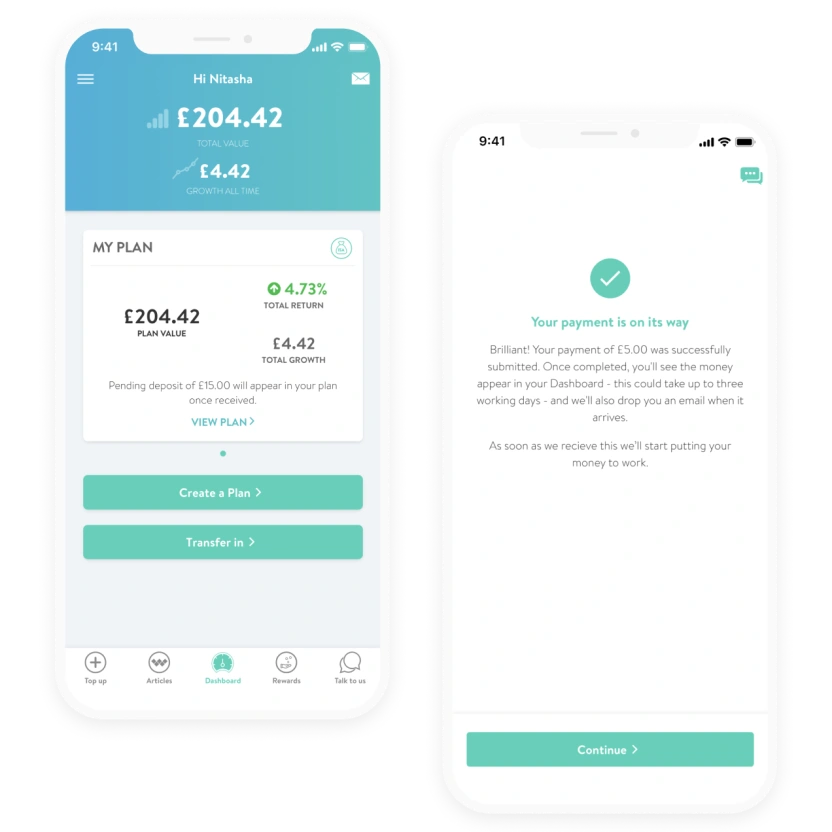

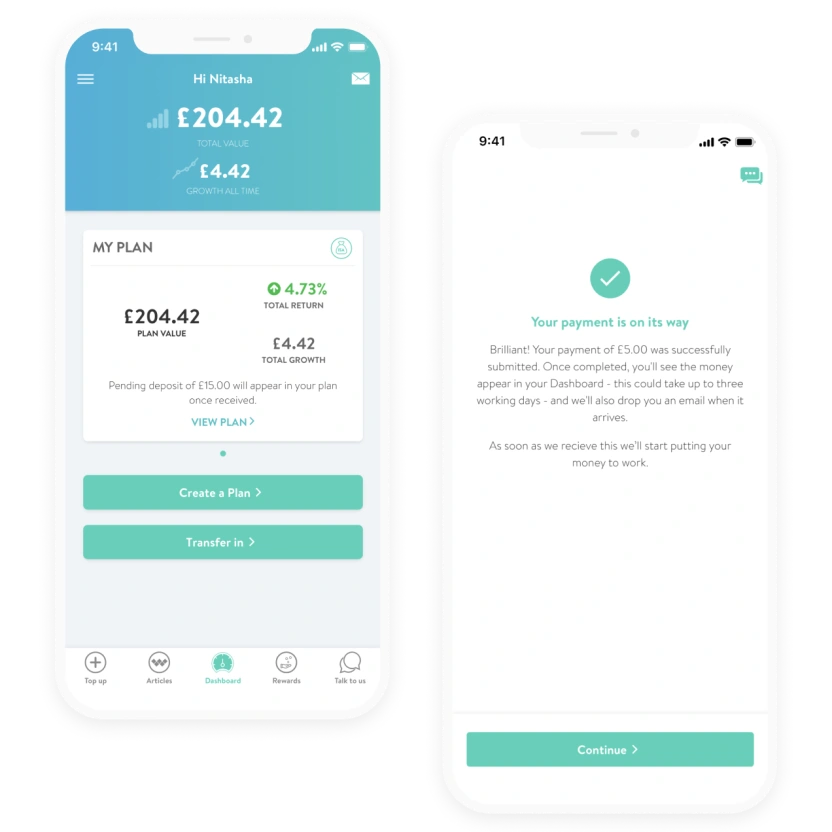

Learn about customer onboardingWealthify uses Tink to get money to market faster

Challenge

Simplifying investing through a frictionless user experience is a key part of Wealthify’s mission. They wanted an account top-up solution that would streamline their onboarding flow while keeping fees low.

Solution

Wealthify chose Tink to deliver a fully embedded payment experience powered by open banking – letting investors transfer funds and start investing in a few clicks.

Payments

Wealthify uses Tink to get money to market faster

Challenge

Simplifying investing through a frictionless user experience is a key part of Wealthify’s mission. They wanted an account top-up solution that would streamline their onboarding flow while keeping fees low.

Solution

Wealthify chose Tink to deliver a fully embedded payment experience powered by open banking – letting investors transfer funds and start investing in a few clicks.

Payments

For industry leaders

“Open banking lets us deliver seamless payment experiences that are quicker and more competitive than traditional card payments. The customer response has been brilliant, and our partnership with Tink means we can maintain our market-leading low fees.”

Simon Holland

Chief Product Officer at Wealthify

Effortless onboarding, instant payments

Enable users to sign up and start using your service in minutes with real-time account verification and instant payments and withdrawals.

Boost conversion

Let users move money in a few clicks and authenticate via fingerprint or Face ID – no need for long forms or manual data entry.

Reduce fees and fraud

Using open banking to power your payments means no card or interchange fees, reduced fraud, and zero chargebacks.

Design better experiences

Customise your payment and onboarding flows to match your brand, no clunky redirects or poorly designed checkout screens.

Simplify operations

Increase your speed to market with aggregated settlement, automated refunds and reconciliation, and easy-to-use reports inside the Tink Console.

Why execs see this as a top open banking use case

We surveyed 380 financial executives across Europe.

Read the report1 in 3

see top-ups or fund transfers as the ideal payments use case for open banking

7 in 10

view instant transfers as the top benefit of open banking

75%

have already invested in open banking or plan to in the next 12 months

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.