Partnerships

We're here to help almost any payments use case with an easy-to-integrate set of tools to accept payments, onboard customers, and simplify risk and operations.

Maximising Revenue

Benefit from flat fees per initiation, regardless of transaction value.

Co-marketing

Working together to take Pay by Bank to merchants and consumers alike.

End-to-end Support

From initial opportunity to in-life support, we’ve got your back at every step.

For industry leaders

“Tink is enhancing the open banking payment landscape, particularly in important markets like Germany. By leveraging the real-time risk analysis during payment processes, Adyen can offer a payment option that not only ensures security and reliability but also aligns perfectly with both merchants' and shoppers' expectations."

Dirk Jan Meijers

Payment Partnerships Lead Europe at Adyen

“We’re very pleased to partner with Tink, the leading player in account-to-account payments. Today we handle hundreds of millions of invoices annually for customers in the Nordics. Open banking lets us expand our offering to now also include simple, compliant, and user-friendly payment solutions integrated in our existing channels.”

Mattias Norén

Head of Strategy at PostNord Strålfors

“Partnering with Tink was an important step in our ambition to improve the user experience, leveraging PSD2 to develop a simpler payment solution. Using Tink as a provider for our new payment service became a natural choice as we explored the market.”

Vesna Lindkvist

CTO at Kivra

“We are delighted to bring Tink’s solutions to Revolut. Our partnership with Tink will enable Revolut to expand our open banking services across new markets in a fast and sustainable way.”

Ivan Chalov

Head of Retail at Revolut

“Enabling people living in Ireland to replace financial worry with financial confidence is a key goal for An Post Money. We are thrilled to have partnered with Tink to enable not only An Post Money customers but everyone living in Ireland to have the ability to manage their money better, stay in control of their expenses and start building financial confidence.”

Bruce Richardson

Product Management Consultant at An Post

Tink offers an incredible amount of out-of-the-box products with basically unlimited possibilities for customisations and new innovations. The overall quality and uptime of their services has been great and we have had no issues at all, even with the enormous amount of new customers we’ve acquired in a short amount of time.

Andreas Norberg

Head of Innovation at Rocker

“By teaming up with Tink, we aim to give Lydia’s users the best possible experience and allow them to easily manage their financial daily lives within our app.”

Cyril Chiche

co-founder and CEO of Lydia

“At Tradera, we always aim to make the user experience as simple and friction-free as possible for our customers. For that reason, our partnership with Tink was a perfect fit for us.”

Stefan Öberg

CEO at Tradera

“Tink's open banking payment system is the obvious choice for our customers – it takes our already instant onboarding experience and adds easy, frictionless payments – enabling anyone to invest in their first crypto in less than two minutes.”

Jamie McNaught

CEO and co-founder at Solidi

“Tink was the obvious choice as a scalable and reliable partner to help make our product experience as simple and as user-friendly as possible.”

Tim Öhman Cirillo

COO at Billogram

“With Tink, it was very easy and smooth to get started. We understood perfectly when we read the documentation and the technical sections the first time and that was a big reason for us to choose Tink. The integration was very seamless and easy.”

Nanna Stranne

CEO and founder, Sigmastocks

“Working together with Tink means we can provide contextual money-saving insights and deliver a personalised, fast and accurate customer experience.”

John Natalizia

Cofounder and CEO at Snoop

“Open banking lets us deliver seamless payment experiences that are quicker and more competitive than traditional card payments. The customer response has been brilliant, and our partnership with Tink means we can maintain our market-leading low fees.”

Simon Holland

Chief Product Officer at Wealthify

One integration for everything you need

Connectivity in 19 markets and counting

Scalable merchant KYB and onboarding

Merchant-level reporting

Merchant-level SDK customisation

Plug in your existing operations

Real-time settlement, same-day merchant payouts

Syncs with existing reconciliation processes

Reporting and analytics data via API

Deploy a market-leading solution fast

Dedicated technical support, 24/7

Go-to-market and merchant enablement support

One master agreement and contract

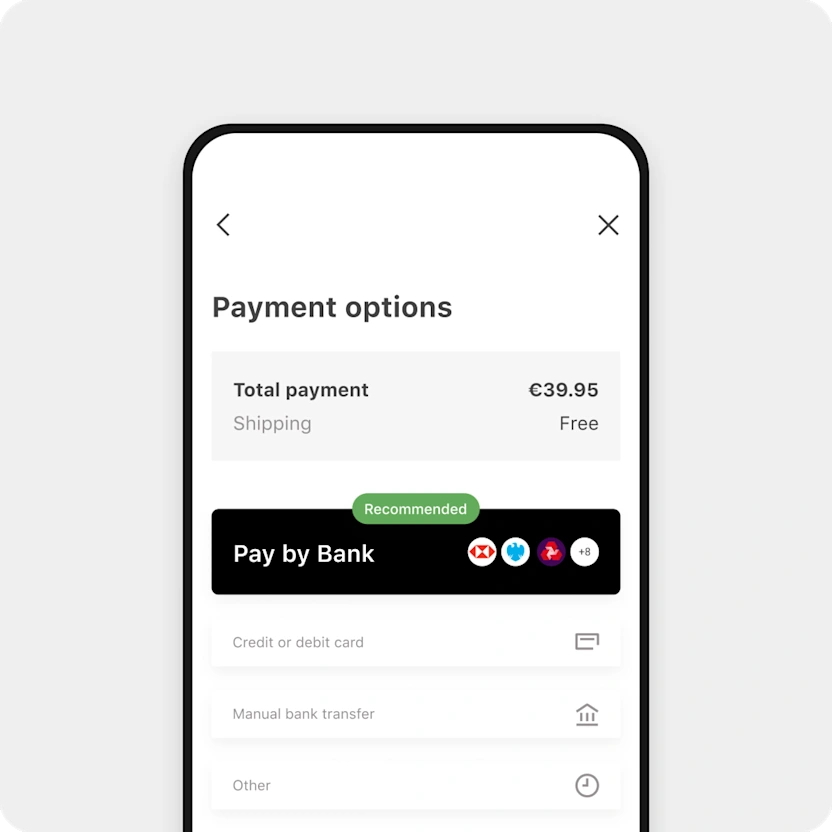

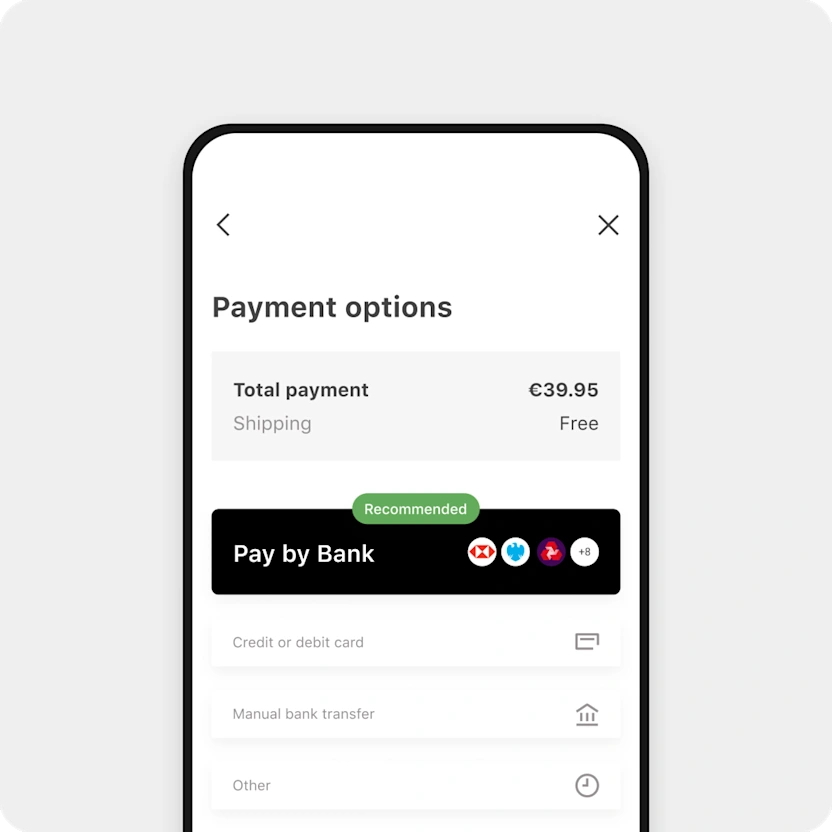

Our Vision for Pay by Bank

We believe in democratising access to financial services, removing any unnecessary barriers or costs to create a fair financial ecosystem that can be used by any consumer.

We’ve invested in the platform, the technical expertise and operational capability. Now it’s time for a global payments network to partner together to bring account-to-account payments to every checkout and payments flow, so consumers have true choice in how they pay.

Get in touch

Our Vision for Pay by Bank

We believe in democratising access to financial services, removing any unnecessary barriers or costs to create a fair financial ecosystem that can be used by any consumer.

We’ve invested in the platform, the technical expertise and operational capability. Now it’s time for a global payments network to partner together to bring account-to-account payments to every checkout and payments flow, so consumers have true choice in how they pay.

Get in touch