The future is access to all data

Much like Tink, the trustee for the UK’s Open Banking Implementation Entity (OBIE) has big visions for the future of data-driven banking. He says it’s only a matter of time until the full scope of customer data is available for fintechs to use to build innovative new products.

“Everyone agrees with the fundamental principles – that data belongs to the consumer and not to the organisation,” Imran Gulamhuseinwala told us at the Money20/20 conference in June.

“Then I think we’re going to start looking very much at other products – mortgages, savings accounts,” he says. “Then other products outside of banking – insurance and so on. And if the UK is anything to go by, we’re already having discussions about water, energy, telco, broadband, utilities – the whole gamut.”

More in Open banking

2024-10-08

6 min read

Lending essentials: how enriched data solutions help lenders tackle constraints

Enhancing your affordability assessment with Tink’s data-enriched solutions helps you put an end to inaccurate data, prevent fraud in loan origination and stay compliant – read on to explore the benefits.

Read more

2024-09-24

4 min read

Why Pay by Bank fits luxury retail like a glove

Pay by Bank offers a solution that addresses the potentially higher transaction fees and fraud risks while enhancing the customer experience for luxury retailers.

Read more

2024-09-03

5 min read

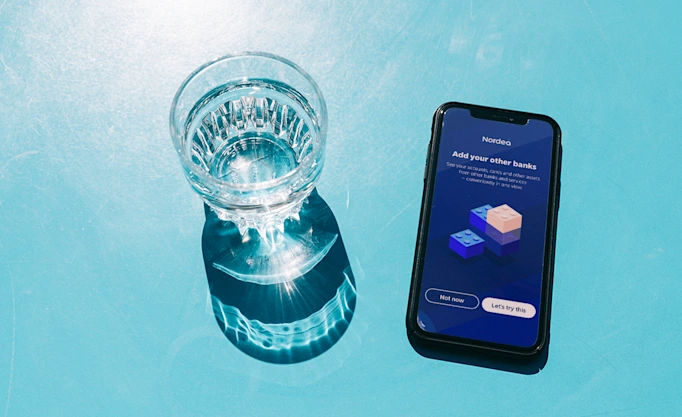

Customer interview – Nordea on consumer engagement

We spoke to Nordea Product Manager Sami Mikkonen about enhancing their mobile app using open banking technology, focusing on improving consumer engagement and financial management.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.