A closer look at UK lending in the cost-of-living crisis

Our latest study shows that the cost-of-living crisis in the UK is having a significant impact on borrowers and lenders alike. As financial pressures mount, many Brits are resorting to desperate measures to secure loans, while lenders are grappling with increased defaults and fraud. Prioritising affordability checks and data-driven consumer lending models is crucial to ensuring responsible lending practices during these challenging times.

New data from Tink has identified a growing cohort of 'bridging borrowers' in the UK – as the continued cost-of-living crisis sees an estimated one-in-four borrowers turn to credit to cover essential spending and 16% take out a loan to make ends meet.

A minority of struggling Brits are resorting to providing false information to secure the loans they need, and with defaults on the rise, lenders are prioritising upgrades to affordability and fraud checks.

So far this year, Tink’s solutions have already helped make better and faster decisions for over 7 million mortgage and consumer loans across Europe – a figure we expect to double in the next six months.

With UK interest rates at their highest for 15 years as the Bank of England tries to bring down inflation (currently 6.7% according to the latest Office for National Statistics data), higher loan repayments and increased borrowing are impacting UK consumers’ ability to make ends meet each month.

Tink’s new research, for which both UK borrowers and lenders were surveyed, indicates that nearly one in three borrowers (29%) find themselves running out of money before the end of each month. For some, this financial strain forces them to turn to credit to cover essential costs. Approximately one in four (25%) have resorted to credit, while 23% have turned to instalment or delayed payment options. Meanwhile, 16% admit to taking out a loan just to stay on top of things.

Lenders seeing defaults rise

Responses from lenders, including mainstream banks, also support the notion that the cost-of-living crisis is causing difficulties for borrowers. While many people are turning to credit to make ends meet, more people are finding it difficult to qualify for loans, with 58% of lenders surveyed noting a greater number of rejected applications due to people not meeting the affordability criteria.

This means that some struggling consumers, who may desperately need access to loans to make ends meet, are going to great lengths to try to secure borrowing, such as exaggerating their monthly income or underreporting their monthly outgoings when applying for finance. In addition, more than one in ten (12%) surveyed say that when refused a loan, they have reapplied with a different lender and altered their credit information so they can access the loan they need.

The revelation that Brits are resorting to drastic measures to secure borrowing is borne out by insights from UK lenders – an estimated 35% of those surveyed by Tink are seeing a rise in application documents being edited.

Tasha Chouhan, UK Head of Banking and Lending at Tink, said: “With many traditional credit checks making it difficult for people to gain access to loans, those who most need financial support are resorting to desperate measures. By prioritising investments in data-driven lending models, lenders can make more informed credit decisions to widen credit access to those who can afford it, while protecting struggling borrowers from getting into financial distress.”

Prioritising robust affordability checks

The vast majority of lenders we surveyed recognise that these trends are a consequence of the current economic situation and the difficult financial situation that many people find themselves in. More than three-quarters (78%) of lenders surveyed believe that fraud risks in loan applications are higher due to the cost-of-living crisis making applicants more desperate.

Perhaps as a result, an estimated 82% of lenders now consider affordability checks more important than ever, and 77% acknowledge the need to improve their risk decisioning models to provide a more accurate view of people's finances.

Data-driven tools key to helping lenders manage affordability and fraud issues

Data-driven risk assessment models give financial services providers, with consumer consent, the ability to view transaction data in peoples’ bank accounts. This enables a holistic approach to gathering insights on income and spending behaviours to inform creditworthiness and affordability – increasing financial inclusion and access, while removing unfair barriers to lending encountered by certain consumer cohorts such as those who have irregular income from multiple sources.

Traditional credit checks combined with onerous, often paper-based processes to provide evidence of expenditure and income levels can be time consuming, out of date and end in higher abandonment or rejection rates.

Encouragingly, the vast majority of lenders (84%) surveyed recognise that data-driven risk assessments are key to ensuring they can accurately assess a borrower's ability to afford repayments.

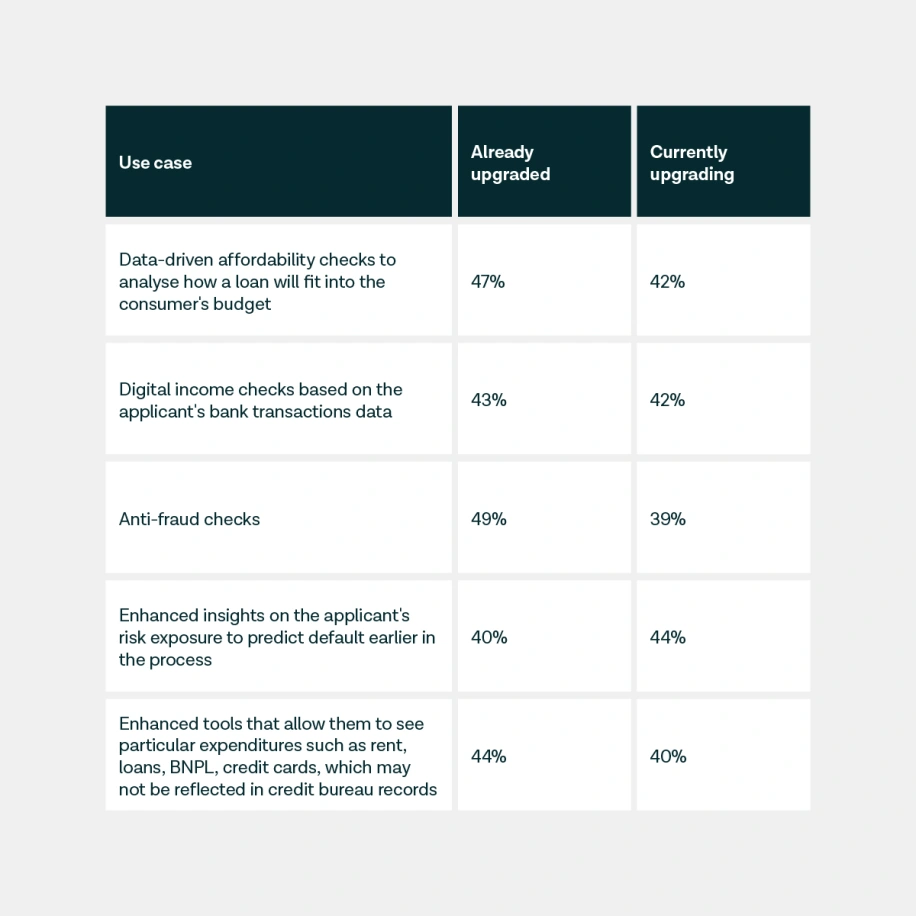

And many lenders are already investing in new data-driven digital tools to enhance their lending models. For example:

Fintech partnerships overcome barriers to adoption of data-driven technologies

An estimated two-thirds (68%) of lenders believe that third-party support is essential to improve their lending models.

And as it stands today, an estimated 43% of lenders are already investing more in fintech partnerships to enhance digital affordability checks as part of their credit underwriting process, while 36% are investing more in fintech partnerships to enhance open banking.

Chouhan continued: “With squeezed budgets and limited internal resources, partnering with a trusted fintech offers lenders a reliable and cost-effective way to make important upgrades to their processes. By embracing data-driven technologies, lenders can ensure they are protecting themselves and their customers today, while future-proofing their models. And we’re seeing this happening now all across Europe. We’ve already helped lenders make better and faster decisions on more than 7 million consumer loan applications in the last year, and we expect to see this double in the next six months.”

---

About the research

Consumer research was conducted by Censuswide on behalf of Tink in September 2023, amongst 1,000 UK borrowers aged over 18 (i.e. those who currently have either a mortgage or a loan).

Lender research was conducted by Censuswide on behalf of Tink in September 2023 amongst 200 executives at a High street bank, Building society, Challenger bank, Payday lender or BNPL lender who have a decision-making role in the lending process.

Case studies, comparisons, statistics, research and recommendations are provided “AS IS” and intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice. Visa Inc. neither makes any warranty or representation as to the completeness or accuracy of the information within this document, nor assumes any liability or responsibility that may result from reliance on such information. The Information contained herein is not intended as investment or legal advice, and readers are encouraged to seek the advice of a competent professional where such advice is required.

More in Tink news

2025-12-03

2 min read

Fidelity introduces Tink’s Pay by Bank for account top-ups

Tink and Fidelity International have partnered to enable account top-ups via Pay by Bank for Fidelity’s Personal Investing customers and advised clients on the Fidelity Adviser Solutions platform.

Read more

2025-10-30

2 min read

Coinbase and Tink partner to launch Pay by Bank crypto payments in Germany

Coinbase and Tink have partnered to launch Pay by Bank in Germany, enabling secure, fast crypto purchases directly from users’ bank accounts and expanding access to the cryptoeconomy with a seamless, mobile-first experience.

Read more

2025-10-20

2 min read

Splitwise expands Pay by Bank across France, Germany, and Austria with Tink

Splitwise is expanding its partnership with Tink to bring seamless Pay by Bank payments to users in France, Germany, and Austria, following a year of rapid growth of our partnership in the UK. This move enables millions more people to settle shared expenses instantly and securely within the Splitwise app, thanks to our open banking technology.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.